Each year, thousands of migrant workers are pouring into developed countries to earn their livelihoods and support their families. These immigrants send money to their families through cross border transfer.

The money amounts to billions of dollars. The estimate of total money sent through remittance per year is more than $200 billion. For many countries like Nepal, remittance is a major source of GDP. In Nepal, the average flow of remittance was $ 6 million in the year 2015 alone.

There are three major operators ruling the world remittance market: Western Union, MoneyGram, and Ria with 1.1 million retail centers, across 200 countries.

There are three major operators ruling the world remittance market: Western Union, MoneyGram, and Ria with 1.1 million retail centers, across 200 countries.

The one question that strikes everybody’s mind is ‘How do remittance works remain the same?’ This article tries to resolve your curiosity on the issue.

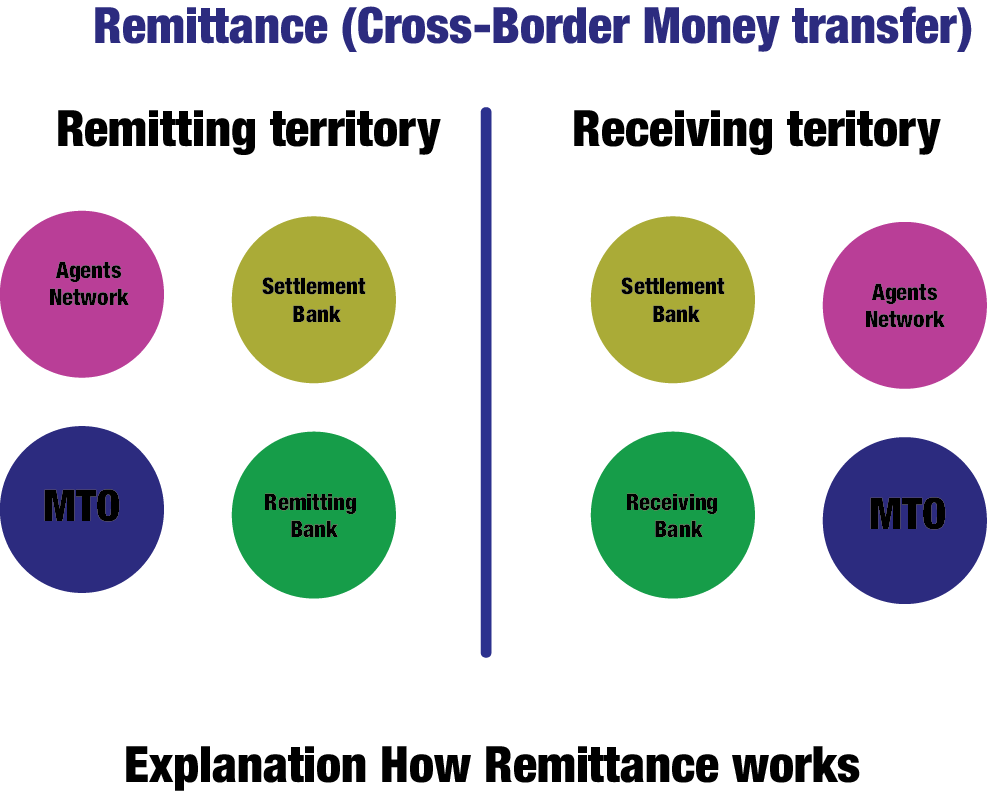

Any types of remittance system contains four parties on each side, Agents Network, Settlement bank, MTO (Money Transfer Operator), and Remitting bank.

There are many systems of remittance all over the world. Among them, pre-pay system is the most famous and dominant one. Any types of remittance system contains four parties on each side, Agents Network, Settlement bank, MTO (Money Transfer Operator), and Remitting bank.

Let us consider a scenario where both the parties can trust each other with advance payment. There comes pre-pay model. The sending MTO places an advance deposit with receiving MTO. Under this arrangement, they agree to a floor price.

In this process, a user walking into an agent network premise uses either cash or some other payment instrument for a Remittance. Let’s say the amount they want to transfer is US$ 1,000. The conversion Rate as provided by the receiving Bank’s treasure Department on the day is 1US$= NRs.110. Let’s also assume the MTO/Agent will split this transaction cost 50/50 and the cost to transfer is US$15.00. So, the accounting would now look like this:

- Funds to transfer: US$1,000

- Cost to transfer funds: US$15.00

- Exchange rate: 1US$ = NRs.110

- Amount to be received by the recipient: US$ 1000 x 110 = NRs.110,000

The fees for the transfer (US$ 15.00) is not converted.

As per the US law, the complete breakdown of the transaction, including the exchange rate and what the beneficiary would receive has to be provided at the time of the transaction to the person sending the funds.

Remitting MTO sends instructions via a real-time system (if integrated) or off-line Message (if not integrated) to beneficiary MTO to pay US$1,000 to the beneficiary from the pre-pay account and use the conversion rate of US$1=NRs.110 and the credit amount immediately.

The receiving MTO makes money on the exchange Rate. The actual exchange rate may be 1 US$ = NRs.112, so the MTO’s Receiving Bank will quote NRs.110 as the exchange rate and pocket NRs. 2x (transfer amount) as its income

The MTO’s receiving bank then forwards the money in Nepali Rupees after conversion to the settlement bank for direct account credit to the beneficiary’s account. With the transfers completed, this is what the status looks like right now, there are two elements missing: the US$ 1,000 that was received by the MTO in the remitting country, and the one that needs to be sent across to the prepay account to level or top up the balance. The receiving MTO makes money on the exchange Rate. The actual exchange rate may be 1 US$ = NRs.112, so the MTO’s Receiving Bank will quote NRs.110 as the exchange rate and pocket NRs. 2x (transfer amount) as its income, which in this case would be NRs. 2x 1000 = Rs. 2000 as the income.

The last open item left is to ensure the US$ 1,000 that is residing with the sending MTO to be sent to the receiving MTO’s Bank via SWIFT Transfer. Once all the funds are settled and payments sent across, the eco-system would be maintained.

By Ajay Pandey

The writer is currently doing his internship at Glocal Khabar.